Things to Keep in Mind When Selecting a Payment Gateway Provider

- 0

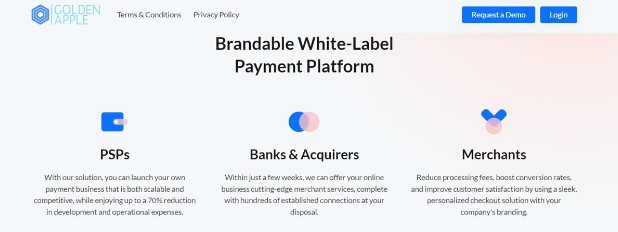

The decision to choose the right payment gateway for your business is a big one that you simply cannot afford to mess up. Once your store is open for business, the role of a suitable payment gateway becomes even more pivotal. It’s not just about completing transactions; it’s about seamlessly connecting your products or services with the payment preferences of your customers. As your business evolves and gains momentum, the payment processor becomes more than a mere financial intermediary; it essentially becomes a partner. This ally should not only adapt to your current needs but also anticipate the changing demands of your growing enterprise.

If you are looking for a reliable payment gateway provider but don’t know how to choose one, continue reading this piece as we will discuss some important things to keep in mind for making the right decision.

Consider the Charges

Navigating Goldenapple payment gateways require a keen eye for fees and charges. As you start working on selecting the right payment gateway, your initial checkpoint should be a thorough examination of the associated costs. These costs typically manifest in various forms, including setup fees, transaction fees, currency conversion fees and more. But it doesn’t stop there – some payment gateways introduce additional charges for specific functionalities like fraud prevention, recurring billing, or supporting multiple currencies.

To make an informed decision, it’s crucial to engage in a comparative analysis of the fees and charges across different options available to you. This financial scrutiny should align with your budget constraints and anticipated sales volume, ensuring that your chosen gateway doesn’t become a financial bottleneck.

Keep a Lookout for Additional Charges

A careful examination is necessary to uncover any hidden charges or subtle clauses. These concealed elements could potentially inflate your costs over time, making it imperative to read between the lines and safeguard your business from unexpected financial surprises.

It would be fair to say that the financial aspect of choosing Goldenapple payment gateway quite similar to creating a balanced budget – understanding the costs, foreseeing potential fluctuations, and ensuring that every penny spent aligns with the value and services you receive.

Make sure It is Compatible

Beyond fees and charges, another crucial element in the quest for the perfect payment gateway is compatibility. First and foremost, compatibility with your e-commerce platform is vital. Whether your online store is powered by a self-hosted solution, or if you’ve opted for a hosted solution, the chosen payment gateway should be in perfect harmony with your platform of choice. But the integration journey doesn’t end there. Look for a payment gateway that opens its arms to various integration options tailored to your technical skills and preferences.

Whether you’re well-versed in the intricacies of SDKs, APIs or prefer the simplicity of plugins and extensions, the ideal payment gateway should offer a suite of options that align with your technological comfort zone.

Furthermore, make sure the payment gateway you choose effortlessly connects with your other tools and systems, forming a cohesive ecosystem. This includes compatibility with your accounting software, a CRM, a collaboration with your email marketing service, and a seamless integration with your inventory management system. It’s not just about processing payments; it’s about ensuring that every facet of your business works together harmoniously.

The Features Make a Big Difference

When picking a payment gateway like the one offered by Goldenapple, it’s crucial to look at the features it offers for your online store. Check if it supports the ways your customers like to pay, such as credit cards, bank transfers or digital wallets. Additionally, see if it provides different payment choices like one-time payments, subscriptions, or split payments. Make sure the payment process is smooth and easy for your customers.

Also, do not forget to check if it follows security rules like PCI DSS and whatnot. A reliable white label payment gateway should also have the tools to detect and prevent fraud. The inclusion of a user-friendly dashboard, analytics, and features for managing payments, disputes, and notifications is also vital.

It Should Offer a Free Demo

Another key aspect to weigh when selecting a payment gateway is the opportunity to test it before making a commitment. Ideally, seek out a payment gateway that provides a free trial or a demo account, enabling you to explore its features and functionality without incurring any charges. This hands-on experience allows you to gauge whether the gateway aligns with the requirements of your business.

This will allow you to simulate transactions, allowing you to observe how the system operates without impacting your live account or inconveniencing your customers. It’s just like a trial run, providing you with valuable insights into the gateway’s performance under simulated conditions. The ability to test and trial different payment gateways plays a pivotal role in your decision-making process. It’s a practical way to compare options, ensuring that the gateway you choose seamlessly integrates with your e-commerce operations.